Is your equity working for you?

NZ Property Investment

The difference between a smart investment and a long-term regret often comes down to one thing: your strategy. With a merely average plan, it’s easy to buy an average property at the wrong time, leaving you stressed and topping up the mortgage.

Successful investors are selective. They assess deals with a proven framework and understand the cost of emotion and the price of inaction. We know, because we help them do it every day. Our advice is based on what’s working in the market right now, not years ago.

Before you throw your equity at the next ‘maybe’ deal, let's talk.

Be picky. Be strategic. And end with an offer that wins :)

Ready to build your property portfolio or optimise the one you have? Growing your investments requires a sharp strategy and the right numbers. This page gives you direct access to the financial calculators, strategic tools, and frameworks our award-winning advisers use every day to help customers build wealth through property.

Speak to a specialist mortgage advisor today? If at you have questions or need extra help, book a call with one of our financial advisors. We can talk about your investment goals, clarify your financial position, and look into equity options to support your plans.

After your call with a Blueprint advisor, we’ll dive deeper with a fact find and strategy session to craft a bulletproof borrowing strategy. By understanding your goals, finances, income, and current investments, we can optimise your investment lending, secure borrowing on your behalf, and set you on a path to success. Your meeting would always be fully tailored to your situation, but here are some of our approaches to the key topics:

How much deposit do I need?

To buy an investment property you’ll need a deposit. The amount will depend on what you’re buying and your ability to service a mortgage - here’s what you’ll typically need:

- Buying a new build straight from the developer: 20% of property value.

- Buying an existing build: 30% of property value.

For example, if you bought at the average price in NZ, which is around $900,000 at the time of writing, you’d need roughly $180,000 for a 20% deposit and $270,000 for 30%.

Welcome to our newsletter.

Successfully submitted. You should receive your welcome email within 5-10 minutes.

Make smarter decisions with the tools the experts use. Join our newsletter for important market insights and get instant access to the three essential calculators we use to help our clients succeed.

You'll receive our:

- 3-Property Comparison Calculator: Analyse rental yield and cash flow to find the best investment for you.

- Fixed Rate Comparison Tool: Model different interest rate scenarios to structure your loan with certainty.

- Revolving Credit vs. Savings Calculator: Discover how to make your money work harder and pay off your mortgage faster.

What if I don’t have enough for a deposit?

Most Kiwis don’t have a couple hundred thousand dollars lying around. The good news is, you may not need it. To find out for sure, apply for a pre-approval. Here are some alternative ways to come up with a deposit:

Using equity in your home or other properties

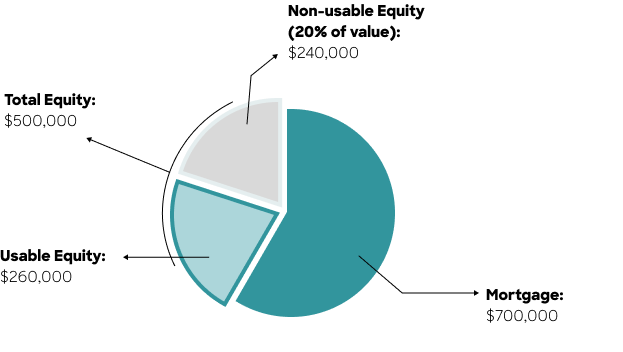

Equity is the value of your home less your mortgage amount, or in other words, the amount you’d receive if you sold your home and paid off your mortgage. If you’ve got a certain amount of equity in your home, lenders may allow you to borrow against it to finance your deposit.

You’ll usually need to leave 20% equity in your home but you may be able to borrow against the rest. We call anything above 20% in your main home ‘usable equity’, whereas anything above 30% equity in an investment property is generally ‘useable’.

- For example, let’s say your main home is worth $1.2 million with a $700,000 mortgage.

- That’s $500,000 equity in total.

- You’d need to leave 20% equity in the home, which is $240,000, but you could use the rest.

- You’d have $260,000 usable equity, almost enough for a 30% deposit on a $900,000 home and enough for a 20% deposit on a $1.3 million new build.

To ‘unlock’ this equity you’ll need to speak to a mortgage broker or lender, who’ll assess your financial position and serviceability and then look at increasing your mortgage to provide cash for your deposit (assuming you meet lending criteria).

Equity is the reason property investment is so accessible for so many older New Zealanders. Many Kiwis have owned their home for years or even decades, and by paying off the mortgage or through value increases their equity has increased. Some don’t even know it, but they’ve got a deposit ready to go - all they need to do is access it.

- Wanting to invest in your first property? Book a Mortgage Advice meeting.

- Wanting to review your investment lending? Book a Portfolio Review.

- Want to go investment property shopping? Secure a Pre-Approval?

- Have a live deal? Book a Signed S&P meeting.

Buying with a smaller deposit

The Reserve Bank of New Zealand sets rules around how much deposit investors must have to purchase property. These are called loan to value ratios.

- A 30% deposit is required to buy existing homes.

- 20% is required to buy a new home straight from the developer.

However, 5% of every bank's lending can be to borrowers with less than that amount. The trick is finding the banks who have a little room in their quota and convincing them that they should lend to you.

The mortgage advisors at Blueprint Finance can make this easier. We’ve got good relationships with most lenders and can advise which bank is most likely to offer low LVR lending at any given time.

Going with a non-bank lender

Non-bank lenders are financial institutions that aren’t registered banks, so they can’t take deposits or offer transaction accounts. They’re legitimate businesses that are subject to some of the same legislation, but aren’t governed by the Reserve Bank’s LVR rules.

That means they may be more willing to lend to borrowers with small deposits. If the banks say no, it’s worth considering non banks - just keep in mind that you may be charged interest rates and fees.

Withdraw from the bank of mum and dad

If you don’t have enough equity or cash to make up your deposit you may still be able to invest. If your parents own their own home (and they’re feeling generous) you may be able to use equity from their property to put together your deposit.

This works the same as it would if you were topping up your own mortgage to access equity and cash. We’ve seen some parents gift equity, but typically both parties create an agreement about how the money is repaid (often by repaying the topped up section of the mortgage).

How to pick an investment strategy

Investing in property without a strategy is a bit like driving in the dark with your lights off. It probably won’t end well.

During your strategy meetings with Blueprint Finance we’ll work to understand what you want to achieve, whether that’s being mortgage free, retiring early or funding a better lifestyle. Then we’ll reverse engineer a strategy to help you achieve your goals (and make sure you’re driving with the lights on).

Here are the most common investing strategies our successful investing clients use:

Buy and hold

Buying and holding involves purchasing a property and renting it out for the long term, sometimes until retirement or beyond. The priority here is to find a property that’s likely to increase in value over several years, but also has a high net rental yield (which is easier said than done). The income from rent, minus expenses should ideally cover all or most of the mortgage.

This is a great strategy for most people because it’s fairly hands-off, with minimal specialist skill required. The risk may also be less because you’re holding a property for a long period of time, and may be less affected by market fluctuations.

The ideal mortgage for this strategy should be simple and low cost to maximise yield. Speak to a mortgage broker to tailor a mortgage structure to your specific strategy.

Pros

- Hands off - not much work required.

- Usually no need to spend more money to renovate.

- May be the least risky option.

Cons

- May take a long time to build equity.

- If rental income doesn’t cover the mortgage holding the property can be difficult.

Buy, renovate and hold

If you’re keen to get a bit more hands on, buying, renovating and holding may be for you. This strategy involves purchasing a rental property that can be easily improved in a way that increases its rental yield - by adding a room or making cosmetic improvements, for example. The ideal mortgage for this strategy should be low cost to maximise yield, possibly with a revolving credit to fund renovations if necessary.

Pros

- Rental returns may be better than the buy and hold strategy, which may make the property easier to hold long term.

- Renovations may help you build equity quickly if executed well.

Cons

- More investment required upfront.

- You’ll need to be confident completing a renovation.

- More risk involved.

Buy and flip

Buying and flipping involves purchasing a property then hopefully selling it soon after for a capital gain. Investors who use this strategy usually renovate to add value and may not tenant the property at all before selling.

To succeed using this strategy you’ll need to purchase a property well, preferably below market if possible (if you pay too much you’ll risk losing money when you sell). You’ll also need to find a property you can easily add value to, and preferably have some knowledge about construction to make renovation easier.

The good thing about this strategy is that you’ll get cash in hand much quicker than with the buy and hold strategy. On the other hand, if you don’t buy well, or renovations go over budget you could lose money.

The ideal mortgage for this strategy may include floating interest rates in case the loan needs to be repaid quickly and interest only to maximise cashflow - possibly with a revolving credit to fund renovations if necessary.

Pros

- You’ll build equity quickly if you get it right.

- You may be able to use capital gains to buy more property.

- You’ll get cash quicker.

Cons

- This is a riskier strategy. If you don’t buy well, you could lose money.

- More time and effort is required.

- Renovations frequently go over budget or can take longer than expected.

A note on tax

As a property investor you’ll be subject to taxes, on rental income and potentially capital gains. It’s always best to understand your tax obligations before you buy and sell property:

- You may be subject to the Bright Line rule if you sell within a certain period - more on this later. If your property investments are held personally, this will be paid at your top marginal tax rate.

- If you buy with the intention of trading (buying and selling) properties for a capital gain you may need to pay income tax on your profit. If your property investments are held personally, this will be paid at your top marginal tax rate.

- From April 2024 you’ll be able to deduct 80% of your interest expenses from taxable property income, and 100% from 1 April 2025 onward.

Tax on investment property can be complex. We always recommend that property investors speak to an experienced chartered accountant to optimise the tax efficiency of their investments.

We know several great accountants - talk to us and we’ll recommend someone who can help.

Understanding the Bright Line rule

According to the Bright Line Rule, you have to pay tax on the profits of selling a property if you bought it:

- From 1 October 2015 to 29 March 2018 then sold it within two years.

- From 29 March 2018 to 27 March 2021 then sold it within five years.

- From 27 March 2021 to 1 July 2024 then sell it within 10 years (or five years for a new build).

- On or after 1 July 2024, and sell it within two years.

Property that is exempt from the Bright Line rule includes business premises, farmland and your main home. Speak to your accountant to make sure you understand this rule.

Buying the right property

You might be a property investor for 10, 20 or even 30 years. But a great deal of your money will be made the moment you buy your property. In fact, the property you buy will most likely be the difference between success and mediocre results.

Over the years we’ve seen that successful property investments often have a few things in common:

- They’re often in larger centres with populations exceeding 100,000.

- They’re in areas with growing populations, such as central Auckland.

- Properties ideal for the ‘buy and flip’ strategy are often in areas where demand is very high.

- Good buy and hold investments tend to be low maintenance. For example, an old villa may be a great buy and flip investment but it might cost too much to hold long term.

- Good investments are often in areas where new infrastructure is being planned, such as new arterial routes, highways or train lines.

With all that said, you should only ever buy a property that suits your investment strategy and your financial circumstances.

For example, if you’re intending to buy and hold, you’ve got limited cashflow and can’t afford to top up a mortgage. It'll be very important to find a property with a high rental yield. These tend to be in more affordable areas. On the other hand, if you’ve got plenty of cashflow you might be able to purchase a property with a lower rental yield and higher potential for capital gains.

Rental yield versus capital gains

Rental yields are the income that your property generates. They are calculated as a percentage of your property’s value - the higher the percentage, the better the yield.

There are two types of rental yield, gross and net. Gross measures the amount of rental income you receive, while net looks at rental income minus all expenses.

The ideal property investment has a high potential for capital gains and a high rental yield, but the problem is one often comes at the expense of the other. For example, the highest rental yields in the country are in the Grey District on the West Coast and Kawerau in the Bay of Plenty, areas not known for their capital gains. Properties in Herne Bay in Auckland have always experienced incredible capital gains but their rental yields are as low as 2%.

The trick to getting the balance between rental yields and capital gains is to think about your strategy and your circumstances when you buy. If you’ve got plenty of cash to top up the mortgage you may want to focus on potential capital gains - if you don’t yield will be the priority.

Buying below market

At Blueprint we’ve been involved in thousands of transactions and we know the NZ property market like the back of our hand. Our team can help you decide on a property’s value during the offer phase, because we know that buying well is the quickest way to gain equity as a property investor.

To buy below market here are a few general tips that have worked for our clients:

- Be prepared to make low offers and have them declined.

- Look for urgent sales and mortgagee sales.

- Keep an eye out for properties that don’t sell at deadline.

- Form a relationship with a number of real estate agents so that you get an early heads up about off-market sales in your area. Off-market often means less competition, and less competition often equals lower prices.

- Look for properties that are marketed poorly. If the photos and descriptions are poor, competition may be low - and the property could be a hidden gem.

- Keep an eye out for vendors selling directly without a real estate agent.

Most importantly, to buy well you should always take your time. Don’t get fixated on one property - the deal of the century comes around once a week, and there’ll always be another.

How to structure your mortgage

Your financial circumstances, your goals and your investments are unique - so your mortgage should be too. In our mortgage strategy meeting we’ll work to understand what you want to achieve and tailor your mortgage to help you get it done.

Fixed or floating?

We generally recommend that our clients are on fixed interest rates, but not always. Fixed interest rates are usually lower, they provide certainty (your repayments are the same every month) and you’ll benefit if market rates go up (because yours is fixed). However, there are instances when a floating rate may be appropriate. For example, if you’re intending to repay the entire loan after quickly buying and selling, a floating rate may be the better option to avoid break fees.

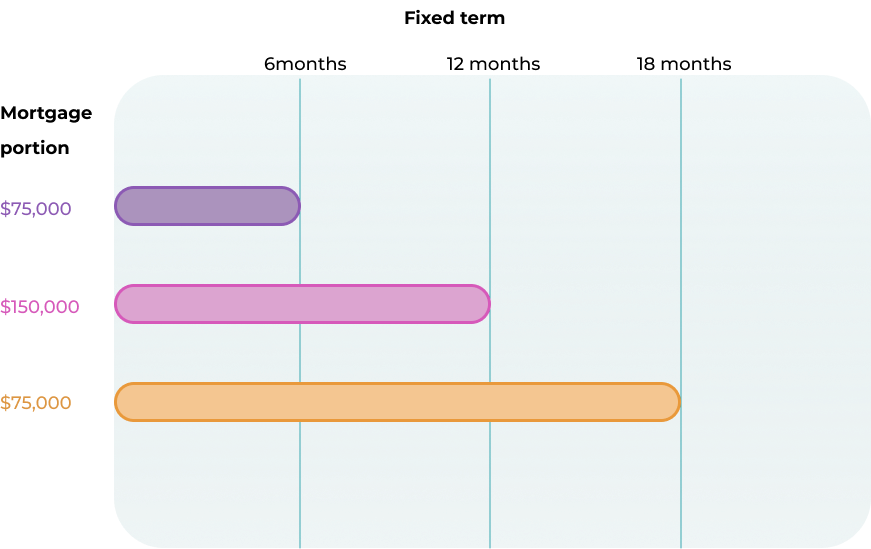

How long should I fix for?

Fixing your interest rates is always a tough task. But with Blueprint Finance we make it easier by providing expert advice and insights into the market to help you make the right decision, although one can never truly predict the future. We often recommend interest rate averaging, which is when you split your mortgage up into several portions, each fixed for a different period of time.

For example: Let’s say you had a $300,000 mortgage and there were strong indications interest rates were about to start decreasing. We might recommend a structure that looks like this:

- $75,000 fixed for six months.

- $150,000 fixed for one year.

- $75,000 fixed for 18 months.

With this structure you’d have a chance to refix regularly to take advantage of falling rates, but if rates increased the change to repayments would be gradual.

Revolving credit

Revolving credit is one mortgage tool that we recommend to several investors, especially those who are completing renovations. It turns part of your mortgage into a large overdraft, and you’ll only pay interest on the money you withdraw.

With one of these you can progressively withdraw funds for renovations, repairs or construction as needed and you won’t need to pay interest on any funds you haven’t used. This is a better alternative to personal loans, usually with a lower interest rate.

Interest only

We generally recommend our investor clients make principal and interest repayments on their loans, but in some limited cases an interest only loan may be appropriate, such as:

- When you need cashflow to buy more property.

- During renovations or construction.

- When you only plan to hold a property for a limited time before flipping for a capital gain.

Not sure what structure is right for you? Download our fixed rate and revolving credit calculators, to workshop some scenarios. This is one of the calculators for subscribers and is in the newsletter welcome email.

Welcome to our newsletter.

Successfully submitted. You should receive your welcome email within 5-10 minutes.

Make smarter decisions with the tools the experts use. Join our newsletter for important market insights and get instant access to the three essential calculators we use to help our clients succeed.

You'll receive our:

- 3-Property Comparison Calculator: Analyse rental yield and cash flow to find the best investment for you.

- Fixed Rate Comparison Tool: Model different interest rate scenarios to structure your loan with certainty.

- Revolving Credit vs. Savings Calculator: Discover how to make your money work harder and pay off your mortgage faster.

As a property investor, you’ll want to surround yourself with a team of professionals to help you make the hard decisions. At Blueprint finance we’ve been in the industry for many years and we have a huge network of professionals we can recommend including:

- Conveyancers and solicitors.

- Buyers agents and real estate agents.

- Accountants.

- Experienced building inspectors.

- Insurance brokers and experts.

- Property managers if you’re renting your property out.

- Quantity surveyors if you plan to subdivide or build.

- A good builder or project manager if you’re building or renovating.

Last but not least it’s a great idea to speak to a financial advisor and mortgage broker to make sure you’re getting a competitive interest rate and that your mortgage is structured correctly.

Ready to take the first step toward optimising your investment lending?

- Email. Send a message to support@blueprintfinance.co.nz

- Call. Get in touch via 0800 769 108.

- Request a personalised meeting, use the Agenda Builder.

- Schedule. Take a look at our advisors, and book in via their calendly link.

Relevant advisory services:

DISCLAIMER: The information contained in this page is general in nature. While facts have been checked, this information does not constitute a financial advice service. The article is only intended to provide general information about home loans. Nothing in this article constitutes a recommendation that any strategy is suitable for any specific person. Without speaking to you we cannot assess anything about your personal circumstances, your finances, or your goals and objectives, all of which are unique to you. Before making financial decisions, we highly recommend you seek professional advice.