Home owners: Financial Strategies We Use with Clients

Is your mortgage structured to save you money and help you get ahead? Your home loan is typically your biggest expense, but it can also be your most powerful financial tool. We've compiled the guides, calculators, and frameworks our advisers use to help homeowners lower their interest costs, pay off their mortgage faster, or strategically unlock equity for their next big goal.

Owning a home is just the beginning. What’s next for you? Whether you want to buy an investment property, upsize, downsize, cut years off your mortgage or do it all - we’ve helped thousands of homeowners like you reach their goals.

To help you get started we’re lifting the curtain and sharing the process we use with our clients, plus everything we’ve learned during our years working as financial advisors.

You’ll learn about:

- How to calculate the usable equity in your home.

- How you can use your equity.

- Smart ways to structure your debt that’ll give you more control.

- How you could buy an investment property with no cash deposit.

- How you could cut years off your mortgage.

Ultimately, this guide will provide you with a blueprint to getting the most out of your mortgage - whatever that means for you.

Speak to an expert today

If at any stage you’ve got questions, or you’d like a little help, book a 15 minute discovery call with one of our financial advisors.

You’ll talk to an experienced advisor who’s been named as one of New Zealand’s top 50. We’ll talk about what you want to achieve and clarify your financial position so we can help you develop a plan and reach your goals.

Your meeting will be tailored to you - but below is a selection of topics we often cover during our lending strategy sessions.

Equity - the homeowner’s superpower

Equity Basics

Equity is the 'market value' of the 'property' less 'mortgage debt'. In other words, roughly it’s what you’d receive if you were to sell your house after paying back your mortgage.

For example: Let’s say you owned a property worth $1 million and you had a $600,000 mortgage. Your equity would be $400,000.

Equity is an important concept to understand as a homeowner. That’s because in most cases you can tap into your equity to invest, renovate or spend without selling your house. You can do this by increasing your mortgage - but there are a few rules of thumb you’ll need to know first.

How to increase your equity

When your equity increases, generally the amount that you can borrow increases too. There are two ways that your equity can increase:

1. When the value of your property increases.

2. When you pay down your mortgage.

If you’ve been in your home for several years, chances are you’ve paid off a big chunk of your mortgage. If you’ve done any renovations or improved your home in any way its value might have increased. And even if you haven’t improved your property, the market generally trends upward and its value may have increased over time anyway. In all of these scenarios your equity will have increased.

LVRs explained

The Reserve Bank of New Zealand, New Zealand’s central bank, sets limits on the amount people can borrow against their properties. These are called loan to value restrictions or LVRs.

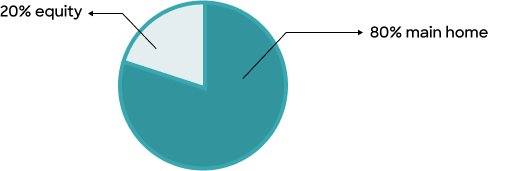

Main home: you can borrow a maximum of 80% of your main home’s value, leaving 20% equity.

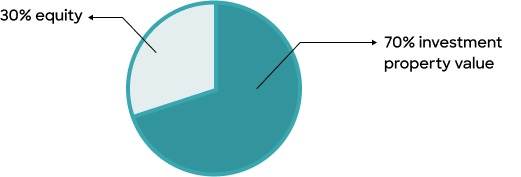

Investment property: you can borrow a maximum of 70% of your investment property’s value, leaving 30% equity.

While these limits apply to the majority of borrowers, there are exceptions. If you don’t have enough equity to make up your deposit in some rare cases banks do lend outside of the LVR rules. In fact, they are allowed to do 5% of their lending to investors with low LVRs (below 30% deposits) and 20% of their lending to homeowners with low LVRs (below 20% deposit). The mortgage advisors at Blueprint Finance have relationships with the banks and applying through us may increase your chance of securing low LVR borrowing.

Contact us to optimise your investment portfolio lending.

What is usable equity?

Usable equity is the amount of equity you have that you can tap into, or borrow against. In other words, for homeowners usable equity often equals total equity minus 20% of home value. For example: Let’s say you bought a home worth $1 million with a $200,000 deposit. If its value were to increase by just 3% every year for five years, it’d be worth $1.159 million. In this case your usable equity would be almost $130,000 (plus any amount you’ve paid off the loan principal).

What can you do with your equity?

If you’ve got usable equity in your home there are countless things you could use it for including:

Renovating your home. Kitchen need an update? Want to add a granny flat to the back yard? Accessing equity by borrowing against your home may be a great way to fund renovations quickly, without the need to save. If you do it right, renovating can add value to your home and increase your equity. Just be careful not to make changes that cost more than the value they’ll add - this is called overcapitalisation.

Buying an investment property. Over 500,000 Kiwis own investment properties, and with good reason. Done well, property investment can be a great way to build wealth and set yourself up for retirement. Using equity in your home to fund a deposit for another property can be a great way to get started. (Select 'Equity Position Evaluation' in the Agenda Builder to have us look into your feasibility and options).

Just keep in mind, you’ll need a 20% deposit for new builds and at least 30% for an existing build (if you’re buying the average house in NZ that’s $171,560 or $257,340). To fund your entire deposit you’ll need quite a large chunk of equity.

Just like buying a family home, we can work with you to get a pre-approval for an investment property.

New builds | Existing builds | |

|---|---|---|

Deposit percentage % | 20% | 30% |

Average deposit amount in NZ | $171,571 | $257,340 |

Helping your kids get onto the ladder. It’s hard for first home buyers, but if you’ve got equity you could make it easier for your kids by providing a deposit. You could top up your mortgage and either give them equity as a gift or subject to a deed of debt (depending on how generous you’re feeling).

Getting cash out. You can use your equity for stuff other than renovating and buying more property, as long as the lender deems it reasonable. That could include a new caravan for the summer season, cash to pay off high interest debts or a new car.

A word of caution

Accessing your equity is another way to say increasing your mortgage. It’s important to remember that and always borrow mindfully. It’s generally best to only finance appreciating assets - things that help you build wealth like property or renovations. You should generally only buy items like cars or caravans on your mortgage if you’re very confident you can afford to pay them off quickly and you don’t have cash handy right now.

Structuring your loan & equity

Your financial circumstances and your goals are unique, so your mortgage should be too. In our strategy sessions we work on tailoring your loan to help you achieve your goals, and make life a little easier. There are several ways to access equity, and you can structure your loan in a way that works for you. For example:

- Topping up to consolidate debt: If you’ve got credit cards, car loans, hire purchase cards or other high-interest debt, topping up to roll it all into your mortgage could be a great idea. You’ll pay a lower interest rate and the minimum repayments may be much lower. To make sure you don’t pay too much interest on the added debt you could simply increase your repayments on your fixed term.

- Using a revolving credit to pay debt down: Do you get large bonuses at work? Or is your income a little lumpy as a business owner? A revolving credit could be a great way to pay less interest and smooth out your cash flow worries, allowing you to withdraw cash from your home loan account without notice.

- Using a revolving credit to renovate: A revolving credit may also be a great way to renovate your home. With a facility like this you can withdraw money when you need it, meaning you’re only charged interest on the money you actually owe. This can be a smarter way to fund renovations than taking out a loan that’s all paid at once.

- Releasing cash as a deposit: If you’re looking to buy an investment property you could simply increase the mortgage on your home and release cash to use as a deposit. That way you may be able to go with a different bank for your investment property home loan to avoid cross collateralisation (cross collateralisation is when you borrow from one bank for multiple properties, which gives that one lender power to sell all properties if something goes wrong).

Fixed versus Floating Interest Rates

- Fixed interest rates stay the same for a set period, usually six months to five years. You’ll get certainty, knowing your repayments will be the same during the fixed period and you’ll be protected if market rates increase (because yours is fixed). The downside is that fixed rates can be inflexible and you may be charged fees for making extra repayments, plus if market rates go down yours won’t.

- Floating interest rates are a bit like a boat on the sea. As interest rates go up and down they float along with them. These offer great flexibility - you can usually make as many repayments as you want without extra fees, and if market interest rates go down you’ll benefit. That said, your repayment amounts may change every month, and if market interest rates go up, so will yours.

We usually recommend that our clients have the majority of their mortgage on fixed interest rates. In most circumstances it’s simply cheaper, but we make recommendations on a case-by-case basis.

Fixed term renewals

One of the drawbacks of fixed interest rates is that when market interest rates go up and you have to refix, it can be a shock when your repayments increase. To protect yourself against this and smooth out changes in repayments we often recommend something called interest rate averaging. This is when you chop your mortgage up into bits and fix each for a different length of time.

For example: You could fix one third of your mortgage for 1 year, one third for 2 years and the remainder for 3 years. That way when your one year is up for renewal if market rates have gone up it won’t be too much of a cash flow shock. Then, chances are in two or three years rates might go down and your repayments will decrease slightly again when you refix the other portions.

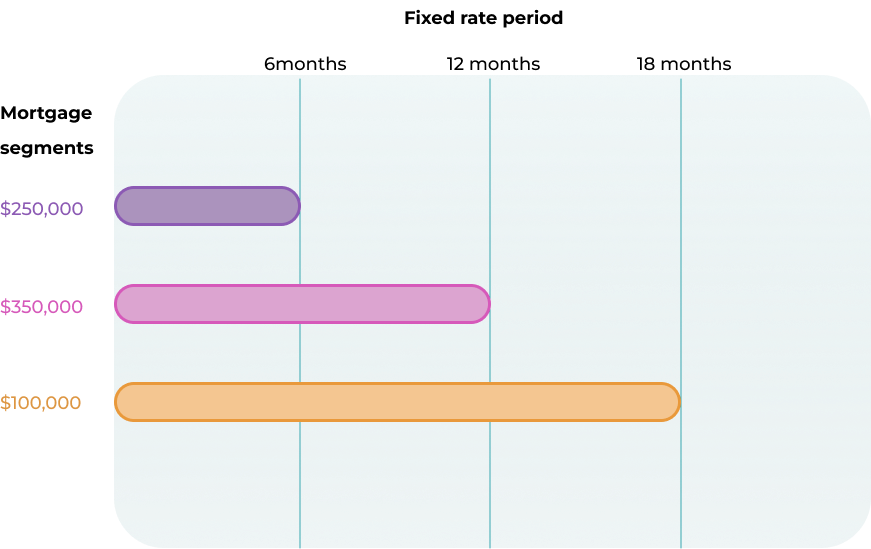

What if interest rates are falling? In our strategy meetings our advice is always tailored to market conditions as well as your personal circumstances. So if we saw clear signals that rates were about to start falling and you had a $700,000 mortgage we may recommend a structure that looks like this:

Using this structure in an environment when rates are decreasing, you’ll get a chance to refix with a lower rate every six months. If forecasts are wrong and rates do rise, then only a portion of your mortgage will be affected.

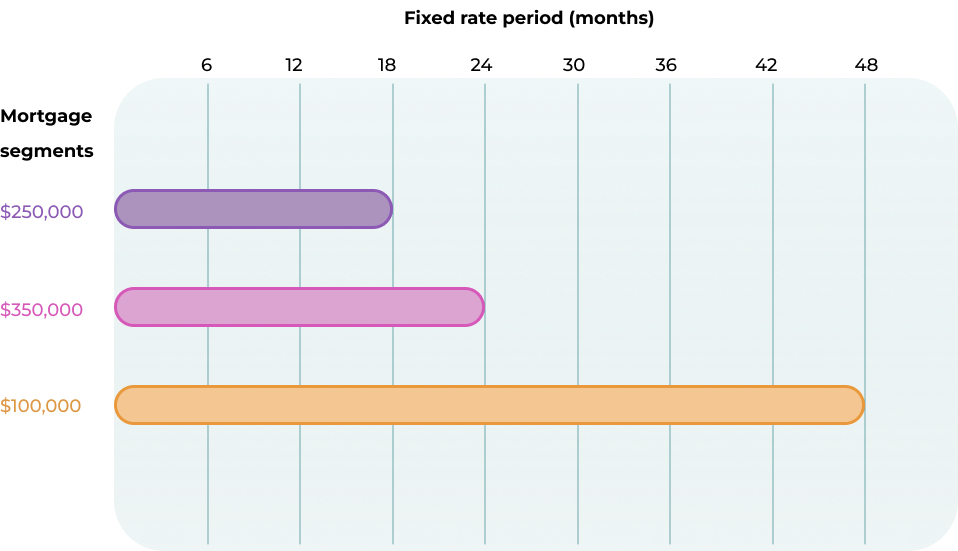

What if interest rates are rising? If rates are rising sharply we may chop your mortgage up differently. For example, we may consider a structure like this:

This structure enables you to make the most of current low interest rates and fix until the interest rate environment has improved. You may feel some effects of rising interest rates, but your repayments will increase slightly over a period of 18 months to four years, instead of all at once.

If your mortgage is renewing, or you want to explore a restructure or refinance here is how we help.

Planning ahead

In our strategy sessions we’ll encourage you to consider your circumstances as well as the market. For example:

Above are just a few examples of how you can tailor your loan to suit you and make life easier. Build a personalised meeting agenda, and talk through all your options with a mortgage advisor to save yourself money and stress for years to come.

Offset mortgage and revolving credits - smart money tools if used right

Revolving credit

A revolving credit, sometimes called a redraw facility, turns part of your mortgage into something like a big overdraft. You can make as many extra repayments as you’d like then you can access all the funds in the revolving credit account at any time, up to a certain limit (including your repayments).

These can be great for people with irregular income who might get paid big chunks some months, then not much the next. They’re also ideal for funding renovations as you can withdraw the money as you need it. To help with the calculations subscribe to our newsletter, you'll get our free Revolving Credit vs Offset Mortgage Calculator in the welcome email.

Welcome to our newsletter.

Successfully submitted. You should receive your welcome email within 5-10 minutes.

Take control of your mortgage renewal with our free Rate Comparison Tool—designed to help Kiwi homeowners make smart, informed decisions.

- Compare short-term vs. long-term fixed rates with ease

- See what future rates would need to be to justify fixing today

- Discover the best mortgage strategy for your unique situation

- You'll also get our equity calculator

- Get clarity and confidence in managing your home loan

Complete the form to receive the Rate Comparison Tool directly via email.

If market updates and our newsletters aren’t for you, please unsubscribe anytime.

For example: Let’s say you’ve got a mortgage with a $20,000 revolving credit. As a business owner you get paid $20,000 one month, then much less for the next two months. You could deposit the entire $20,000 into the revolving credit when you get paid and you’ll pay no interest on that portion while that full amount is in there. Then during your leaner months you can slowly withdraw the $20,000 to cover bills and living costs (but you’ll only pay interest on the money you use).

- Lots of people combine revolving credit with fixed rates: that way you get the flexibility of the revolving credit, combined with the certainty of a fixed rate.

- Revolving credits can be great for reducing your mortgage because they allow you to make extra repayments. You could, for example, get a $20,000 revolving credit, then when you’ve fully repaid it reduce your mortgage by that amount and get another $20,000, rinse and repeat. This can be a great way to pay your mortgage off years earlier.

A word of caution: because you can withdraw the cash in your revolving credit these don’t work for everyone and can end up costing you extra. You need to be very disciplined.

Offset account

An offset account is a transaction or savings account linked to your mortgage. Money deposited into this account directly reduces your loan balance for interest calculation purposes. With one of these you’ll only pay interest on your mortgage principal minus the balance of your offset account.

This is handy if you’ve got a lump sum of cash, or you expect to get an inheritance. In most cases the interest rate return that you receive will be higher than term deposits and savings accounts (especially because these savings are not taxed).

New Zealand Bank Offset and Revolving Credit Products

We are accredited with leading banks to bring you competitive home loan products, bank product details are updated frequently, please check with your advisor or the bank for current details.

- BNZ Bank TotalMoney Home Loans

- ANZ Bank Flexible Home Loan

- Westpac Bank Choices Everyday Floating

- ASB Bank Revolving credit home loan

- KiwiBank Revolving home loan OR Offset home loan

- The Co-operative Bank Revolving Credit Mortgage

Which is right for you? Offset account or revolving credit

It’s a good idea to check your mortgage at least once a year (or every time your fixed rates come up for renewal) to make sure it still suits you. It’s also smart to review your mortgage after big life changes, such as changing jobs, a new family member, or getting a pay rise. The right option for you depends on your personality and your preferences, as well as your goals.

-

An offset account may be better if you prefer to keep your finances compartmentalised and tidy, without sacrificing easy access to cash and still decreasing interest.

-

A revolving credit might be better if you prefer a streamlined, simplified approach where all your money comes in and out of one big account. Avoid revolving credit facilities if you’re prone to impulse spending, or plan to only make minimum repayments.

Not sure which is right for you?You're welcome to speak with our advisors for professional help choosing the right mortgage terms and conditions.

- Email. Send a message to support@blueprintfinance.co.nz

- Call. Get in touch via 0800 769 108.

- Request a personalised meeting, use the Agenda Builder.

- Schedule. Take a look at our advisers, and book in via their calendly link.

Relevant advisory services:

DISCLAIMER: The information contained in this page is general in nature. While facts have been checked, this information does not constitute a financial advice service. The article is only intended to provide general information about home loans. Nothing in this article constitutes a recommendation that any strategy is suitable for any specific person. Without speaking to you we cannot assess anything about your personal circumstances, your finances, or your goals and objectives, all of which are unique to you. Before making financial decisions, we highly recommend you seek professional advice.