First Home Buyers: Insights from our Meetings

Ready to buy your first home but not sure where to start? We get it—the process can feel overwhelming. That’s why we built this page as a clear roadmap, breaking down the entire journey into simple, manageable steps. You’ll find easy-to-use deposit calculators, guides on KiwiSaver and grants, and the same proven frameworks we’ve used to help hundreds of people buy their first home.

Think of this page as an extension of our first-home meetings—except everything is out in the open, ready for you to browse. Here’s what we typically cover with our clients:

- How Much You Need for a Deposit

- Different lenders have different requirements—especially for first home buyers using KiwiSaver grants.

- The Master Sheet shows how your deposit stacks up and when you might reach your target.

- How Much You Can Borrow

- Banks calculate your borrowing power by evaluating income, existing debts, and personal expenses.

- In a quick call, we’ll clarify how lenders view your financial situation—and if any special deals apply to you.

- Which Mortgage Structure Suits You

- Fixed, floating, revolving, or a combination? We help you weigh the pros and cons for your unique needs.

- Use our tools, like the Term Deposit VS Revolving Credit calculator, to see how structure can shorten your loan.

- Tips to Get Your Application Accepted

- Boost your chances by tidying up debts, stabilizing your income, and meeting lender criteria.

- We’ll guide you on the small (but critical) details that make an offer more appealing.

- Strategizing for the Future

- It’s not just about buying now—it’s about positioning yourself for tomorrow. Whether it’s planning renovations, or eventually moving to a bigger place, we’ll help map it out.

The better prepared you are, the easier the borrowing and home buying process will be. After your STEP ONE call the Blueprint Finance team will arrange a fact find and strategy meeting to help you create a bulletproof borrowing strategy.

We’ll deep dive into your goals, your financial position, your income, your KiwiSaver and your investments. At the end of this we’ll have everything we need to apply for and secure borrowing on your behalf.

Getting your first home deposit together

Deposit basics

- Think of your deposit as a way to get your foot in the door with banks and other lenders. It can come from KiwiSaver, savings, investments, gifts from family or bonuses:

- It’s a good idea to aim for 20% of your house price as a deposit if you’re buying an existing home, or 10% if you’re buying a new build. We’ll look at an example of how much this might be later.

- It may be possible to secure lending with a smaller deposit. For high-income earners with minimal debt there are options for a 5% deposit.

- The size of your deposit affects the interest rates you’re offered. Generally, the larger your deposit the better your interest rates will be - if it’s 20% or more you’ll have access to the best rates available.

- The benefit of buying with a lower deposit is that you’ll get into a home earlier, during which time the value of your property may increase.

- The downside, other than higher interest rates, is that you may have more lending conditions.

For example, the bank may require you to get a valuation before buying a property. For example: If you were to purchase a new build apartment at the median price in Auckland central you may only need a 10% deposit of around $55,000. If you were to purchase an existing home at the median price in Birkdale on the North Shore you may need closer to 20% of the purchase price, or $195,000. The size of deposit required depends entirely on the price of the home you’re buying, the type of home, and your profile as a borrower.

View Madhav discussing what a bad 5% deal looks like on our LinkedIn page.

Watch this 10-minute walkthrough that covers key steps of the home-buying process: from how much you can borrow to what legal and upfront costs to expect. It’s a real 2025 example, built for real Kiwis. Then subscribe below to download our First Home Buyer Calculators and get the free cheat sheet: everything you need to plan smart, confident moves. If you're ready to take action or you need advice, please book a meeting or contact us.

Welcome to our newsletter.

Successfully submitted. You should receive your welcome email within 5-10 minutes.

We know the journey to owning your first home can feel overwhelming—so we’ve created a free, Kiwi-focused First Home Cheat Sheet. Sign up for our newsletter to get expert insights on:

- How to secure low-deposit options and first-home grants

- Budgeting tips to prepare for homeownership

- Tracking your mortgage so you can watch it shrink each year

- Building equity as you pay down debt

We’ll also keep you updated on current market trends and share practical tips straight from our team of New Zealand home-loan specialists.

Using KiwiSaver for your deposit

If you’ve been contributing to KiwiSaver for at least three years and meet other eligibility criteria you may be able to use your entire balance (less $1,000) to purchase a home. This will be paid to your lawyer’s trust account and is usually used at settlement, but in some cases you might be able to use these funds as part of your deposit.

Contact your KiwiSaver provider as soon as possible, before you commit to buying a property if you plan to use your KiwiSaver to buy a property.

- It’ll take at least 10 working days for the funds to be paid out after your application, but delays can happen.

- It’s a good idea to arrange a 15+ day conditional period if you plan to use your withdrawal as part of your deposit.

- If you’re using your KiwiSaver as part of your settlement funds it’s a good idea to have a longer settlement (5-6 weeks) to make sure the funds are processed in time. If they’re not, you won’t be able to use them at all.

Note: If you’re buying at auction you won’t be able to use your KiwiSaver withdrawal as part of your deposit. That’s because you need a signed sale and purchase agreement to make the withdrawal, and when you win at auction you’ll need to pay the deposit right away (there’s no time to wait 10 days for your withdrawal).

So, how much can you borrow?

The amount you can borrow is based on a few factors, including the size of your deposit, your income, expenses and investments.

- Banks care about your income and expenses because they want to know that you can afford to make mortgage repayments.

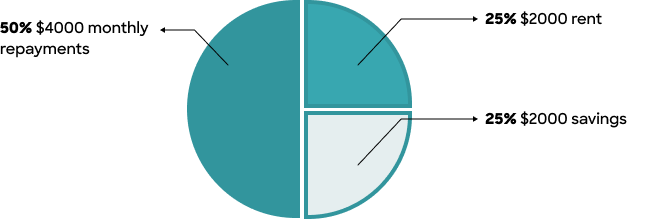

- To get a very rough idea of how much you can afford in mortgage repayments with your current lifestyle, take your rent cost and add how much you currently save each month.

- Having certain debt and expenses may count against you when applying for a mortgage. For example, a car loan with high repayments may hurt your application.

- Banks assess your application with a ‘stress testing’ interest rate that may be up to 2% higher than the real rate. When they work out whether or not you can afford to make repayments they’ll use this interest rate in their calculations instead of your actual rate. This is to make sure you can afford your mortgage in the worst case scenario if rates were to increase.

Rough example of working out your mortgage serviceability: Let’s say you’re putting away $2,000 in savings a month and paying $2,000 in rent. Based on this, lenders may deem that you can afford to borrow $500,000+ based on current interest rates and stress testing. With a mortgage this size your monthly repayments will be around $4,000 per month.

A note on DTIs

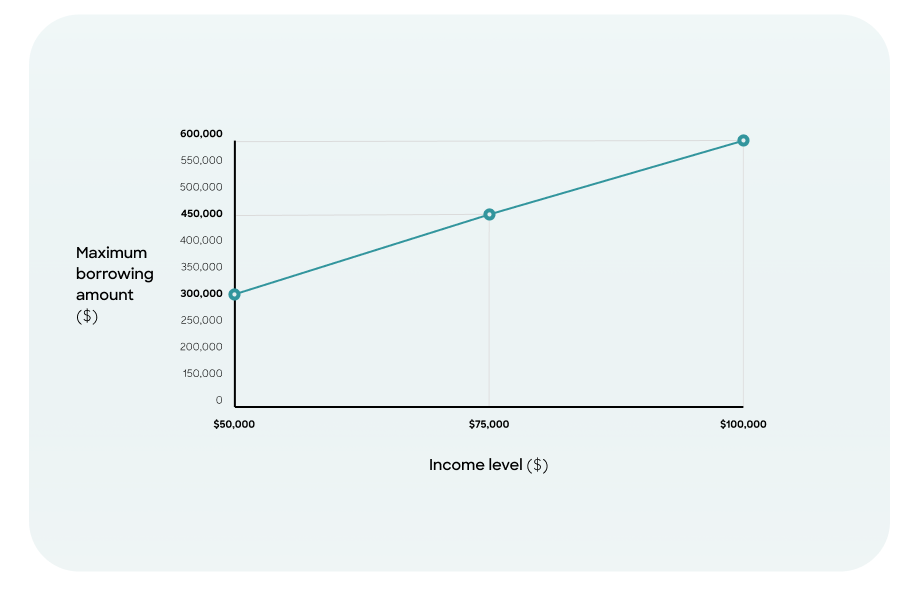

On July 1 2024 the Reserve Bank of New Zealand bought in Debt to Income Ratios (DTIs). This new law restricts the amount that you can borrow as a first home buyer to six times your income.

For example, if you earn $100,000 you can borrow a maximum of $600,000, if you earn $50,000 you can borrow $300,000. Bank servicing requirements will usually mean that you’re able to borrow much less than this amount.

Not quite ready to buy yet?

If you’re looking at the deposit requirements and thinking ‘I’m not ready yet,’ that’s OK. It’s a great idea to speak to a mortgage broker at this stage to create a plan of action that’ll get you into a better position.

Blueprint Finance’s team are qualified financial advisors, which means we can help you get your KiwiSaver and investments in shape. Here are a few things to consider:

Your KiwiSaver contributions

Investing is all about taking small actions regularly over a long period of time. Something as small as increasing your KiwiSaver contributions to 8% can mean that you’re ready to buy a home years sooner.

Hot tip: Whatever you’re doing, make sure you’re contributing at least $1,042 by June 30 every year to make sure you’re receiving the government’s maximum $521 annual contribution.

Make sure you’re in the right KiwiSaver fund

It’s often a good idea to choose your KiwiSaver fund based on the amount of time you have to invest. If you’ve got seven-plus years until you’ll be ready to buy a home, you could go for a high growth or even aggressive fund. If you’re planning to buy in the next 1-3 years, defensive or conservative may be a better option.

Higher growth investments may trend upward in value over time, but they tend to be more volatile, meaning they go up and down in value often. If you’ve got more time you can easily wait out the downturns to make the most of that long-term upward trend. If you’ve only got a year or two, it’s better to go with less volatile investments.

If you are thinking about your KiwiSaver, or are still in a default fund and have never thought about it, we have investment advisors available for you to consult, free of charge. Here is a link for more information about our KiwiSaver planning service.

Savings accounts and term deposits

If you’re buying a house in the next few years it’s a good idea to continue earning interest on your money while you save. High interest savings accounts and/or term deposits may be a great option.

Sometimes it’s helpful to have your savings with a separate bank than your transaction account, to make it a little harder to transfer money out. You could even set up an automatic payment that transfers a set amount into your separate savings account every month as soon as you get paid. This will show lenders that you’re financially disciplined and can afford to make mortgage repayments.

Getting a leg up into your first home

Buying a home may feel like climbing a mountain, but luckily there’s help available. During your Blueprint Finance strategy session we’ll look at all the assistance you may be able to get, including:

Gifting from family

Lucky enough to have a generous family who will gift you money towards your first home purchase? That’s great. The lender may require a signed gifting certificate detailing the amount and any conditions attached to the gift. The gifted amount can be part of your deposit.

Guarantor loans

If your income or deposit aren’t quite enough to get your application over the line, a guarantor loan could be a great solution. The guarantor, usually a family member, effectively acts as a backup if you can’t pay your loan and may have to offer their home as security. That means if you default, they could be on the hook for the entire amount including fees and interest. Worst case scenario, the bank could sell their home to recoup losses if you default.

It’s important that your guarantor knows what being a guarantor entails and seeks independent legal advice if they’re unsure. It’s a big responsibility, after all.

First Home Loans

A First Home Loan is a loan that’s underwritten by Kāinga Ora and issued by select banks. While you’ll usually need a 10-20% deposit, with a First Home Loan you’ll only need 5%.

You’ll still need sufficient income to make mortgage repayments, and to meet your lender’s serviceability requirements. What’s more, you may need to pay a 0.5% lender’s mortgage insurance fee or a higher interest rate.

To check your eligibility and apply for a First Home Loan speak to a mortgage broker and they can make an application on your behalf.

Comparing available rates

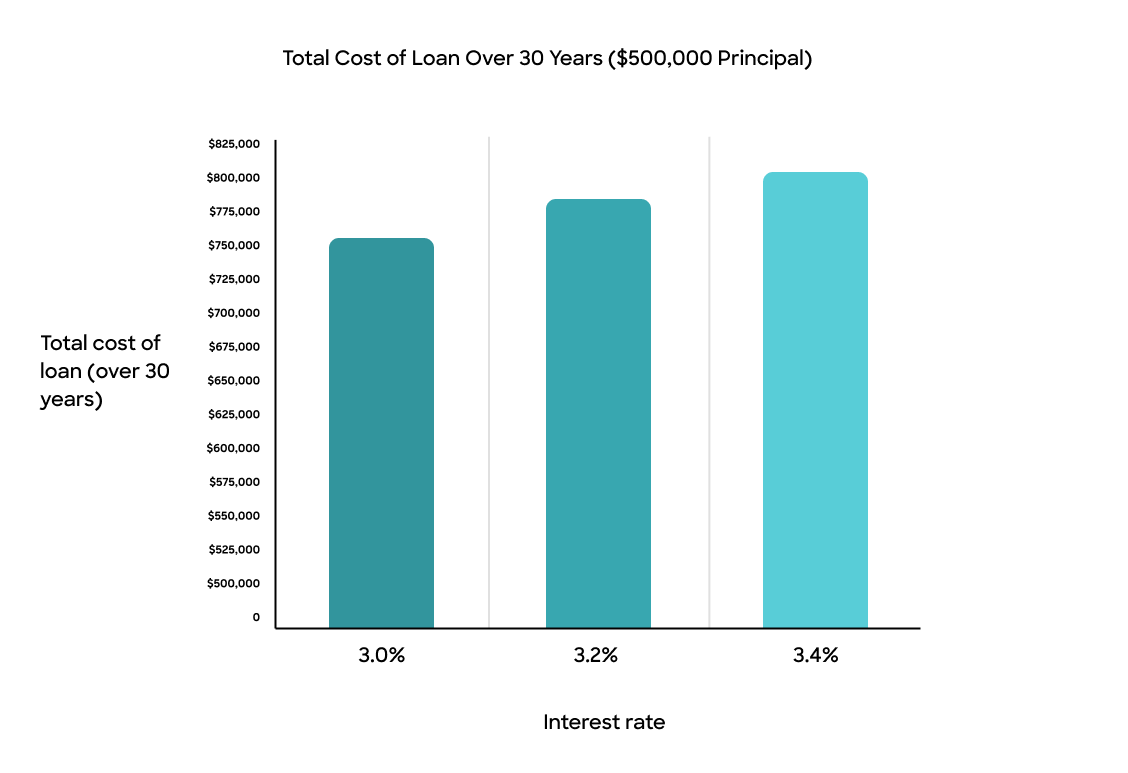

Your interest rate makes up the vast majority of your home loan’s cost. In fact, a rate that’s just 0.2% lower on a $500,000 loan can save you almost $23,000 over 30 years, that’s a lot of freedom.

Interest Rate | Principal | Interest | Total Cost |

|---|---|---|---|

3.0% | $500,000 | $255,539.09 | $755,539.09 |

3.2% | $500,000 | $278,457.59 | $778,457.59 |

3.4% | $500,000 | $301,833.04 | $801,833.04 |

To make sure you get the lowest possible rate it’s a good idea to shop around and check out the offerings of several lenders - you can simply check their websites or contact them yourself to enquire.

The benefit of working with a mortgage broker is that they’ll know exactly what’s available on the market at any given time. Once we understand your goals we’ll connect you with a lender that’ll offer you the best possible rate and terms for your unique situation.

Extra for experts: first home purchase cashback rates

When you arrange a mortgage with a bank they’ll often provide a cash back, a lump sum of cash to sweeten the deal. This varies between banks, some offer $5,000 on loans over $200,000, others offer $3,000 or a percentage of the loan amount.

The catch is that you’ll often need to sign a cash back agreement. This agreement will say you’ll promise to stay with the lender for at least 2-3 years or you’ll need to pay the lump sum back. At the end of this three-year period you can switch banks again for another cash back, or ask for cash back from your existing bank to retain you.

Making your application attractive

Before you apply for a home loan it’s a great idea to do a little financial housekeeping to make sure your mortgage application is accepted. Here’s what we often recommend to our clients in our strategy meetings:

- Pay down debt: when a bank assesses your application, bad debt like car loans, personal loans and credit cards will count against you. It’s a good idea to completely pay these off before applying if you can.

- Clean up your financial habits for three months: banks will look at your account statements for three months prior to your purchase to get an idea of what you might be like as a borrower. So in that period avoid going into unarranged overdraft or missing payments.

- Keep your expenses down for three months: during this period you should also keep your expenses as low and consistent as possible. Avoid large one-off expenses, new debt, gambling or shopping sprees. Act like you’ve already got a mortgage and put as much money aside as possible.

- Avoid a bad credit score: your credit score is a single number that reflects your trustworthiness as a borrower. Miss payments and take on too much debt and you’ll get a bad score, which will have to be explained to your bank. They may charge you a higher interest rate or deny your lending completely - speak to a mortgage broker for help navigating this.

Your mortgage as a tool to reach your goals

Your financial circumstances and your goals are unique. Your mortgage should be too. If your home loan is tailored to you it can be a tool to help you reach your goals rather than a dead weight.

To help you tailor your mortgage to your goals, we’ll run through everything you need to know in our mortgage recommendations meeting. During this time we’ll present a full mortgage strategy tailored to you, including the interest rates you can expect, the structure of your mortgage, and your repayment terms. Here are a few things we’ll discuss:

Fixed versus floating interest rates

Fixed interest rates stay the same for a set period, usually between six months and five years. They are generally a little lower than floating rates and provide certainty that your repayments will stay the same for a set period of time. If interest rates go down during your fixed period you might lose out, if they go up you may save money. This type of rate is less flexible and you might be charged fees for making extra repayments.

Floating interest rates are different. They go up and down with the market and can change at any time, which means your mortgage repayment amount can too. They are however, more flexible and you can make extra repayments without being paid extra fees.

Extra for experts: Interest rate averaging

Choosing the right fixed rate for your home loan involves predicting where interest rates are headed. Unfortunately, no one can do this with absolute certainty.

One alternative is to split your mortgage up into portions and choose different fixed rates for each. This approach means that your repayments stay fairly consistent and you’re not as affected by fluctuations in market interest rates.

For example: let’s say you had a $500,000 mortgage. One option would be to split it up into four portions:

- $160,000 fixed for one year.

- $160,000 fixed for two years.

- $160,000 fixed for three years.

- $20,000 revolving credit.

Revolving credit - turn your mortgage into a big overdraft

A revolving credit is a handy mortgage tool that can give you a little extra flexibility. This feature turns part of your mortgage into a big overdraft - you’ll only pay interest on money you’ve used and you can deposit and withdraw money in this account up to a limit.

One option is to pay the revolving credit down throughout the year to reduce your mortgage by $20,000, then when the next refixing date comes up that portion of the loan is repaid and you turn another portion into a revolving credit and do it all over again. This may enable you to repay your loan faster if used correctly, while giving your access to extra funds if you need them.

Offset account - put your savings to work

If you’ve got savings, an inheritance or a lump sum of cash for any reason, an offset account could be a good idea. Think of this as a savings account, attached to your mortgage. You’ll only pay interest on the mortgage principal minus whatever’s in your offset account.

For example: $500,000 mortgage amount, $100,000 in your offset account - you’ll pay interest on $400,000.

Review your mortgage regularly

Once you’ve got a mortgage, you’re not done yet. It’s a good idea to check yours at least once a year (or every time your fixed rates come up for renewal) to make sure it still suits you. It’s also a good idea to review your mortgage after big life changes, such as a change of job, a new family member, or getting a pay rise.

For example, switching lenders every few years may mean you can get regular cash backs, which will help pay your mortgage off faster. Or when your interest rates decrease you may decide to keep your repayments the same to pay your mortgage off faster.

To make your life a little easier Blueprint Finance will check in with you regularly. We’ll get in touch 60 days before every fixed rate renewal date to make sure your mortgage is helping you reach your goals.

Ready to take the first step toward buying your first home with Blueprint Finance?

- Start the Pre-Approval process

- Request a personalised meeting, use the Agenda Builder

- Take a look at our advisors, and book in via their calendly link

- Get in touch via 0800 769 108 or support@blueprintfinance.co.nz

- Signed a sales and purchase agreement? And need quick help?

DISCLAIMER: The information contained in this page is general in nature. While facts have been checked, this information does not constitute a financial advice service. The article is only intended to provide general information about home loans. Nothing in this article constitutes a recommendation that any strategy is suitable for any specific person. Without speaking to you we cannot assess anything about your personal circumstances, your finances, or your goals and objectives, all of which are unique to you. Before making financial decisions, we highly recommend you seek professional advice.